By John Walker & William Beynon

Key Takeaways

-

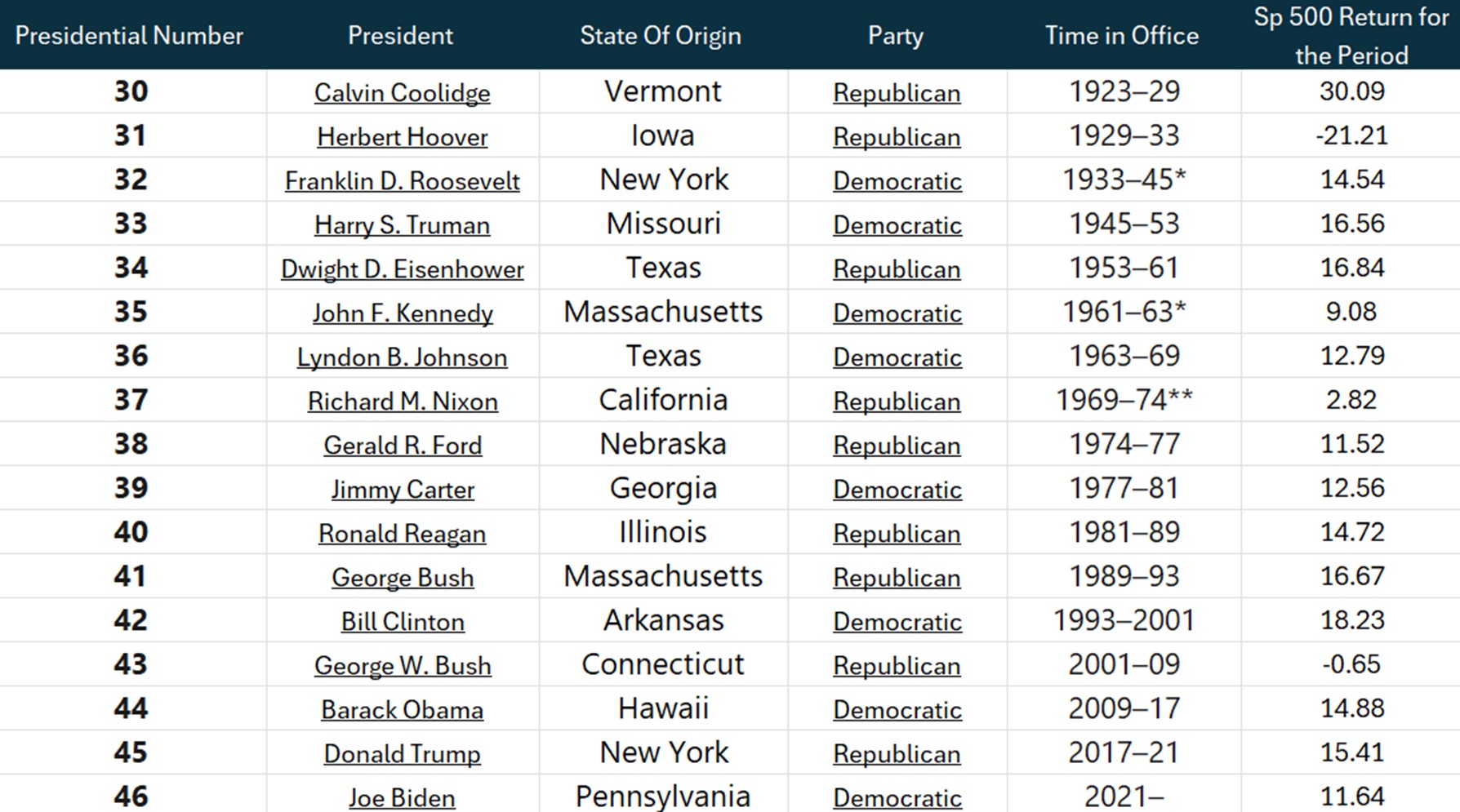

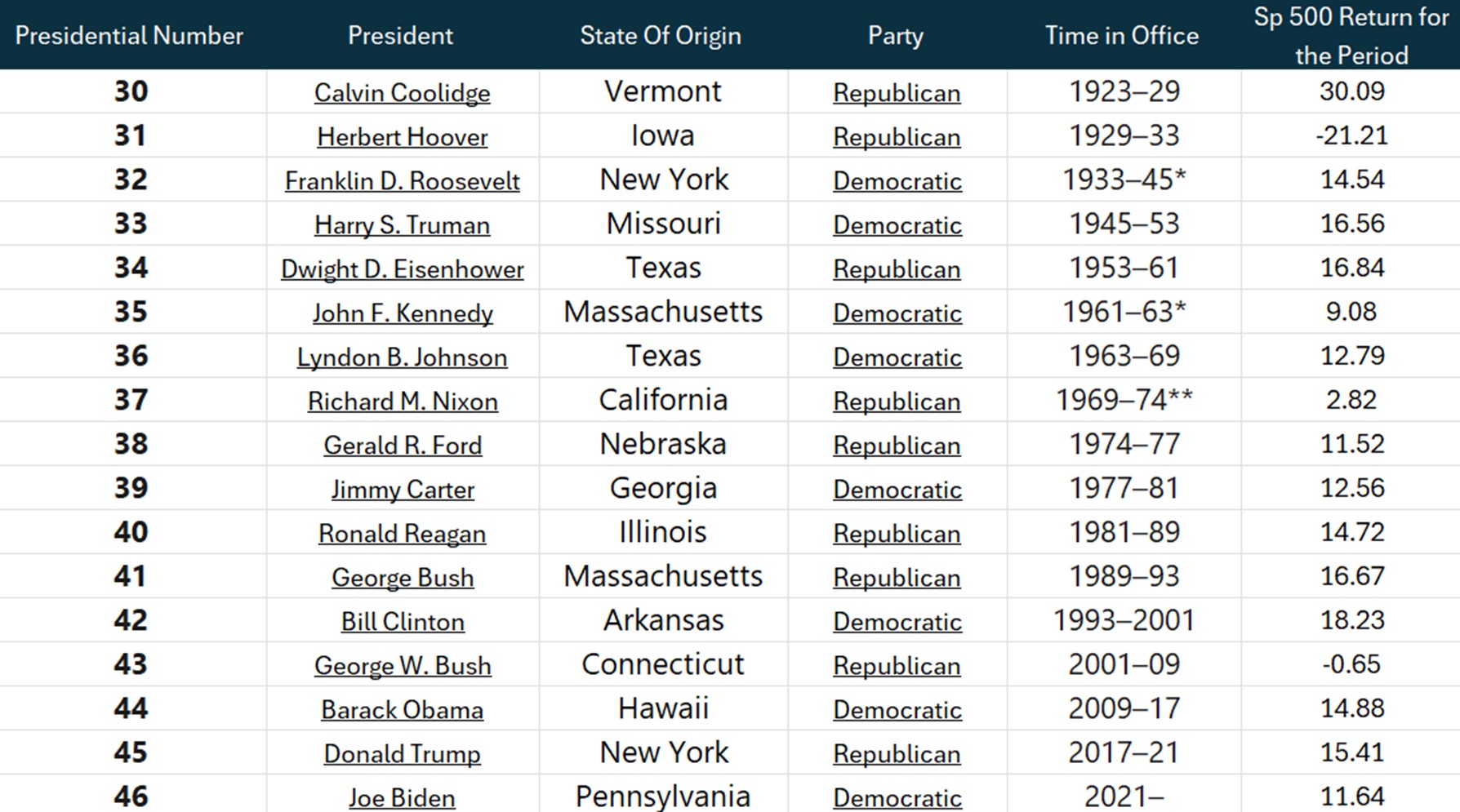

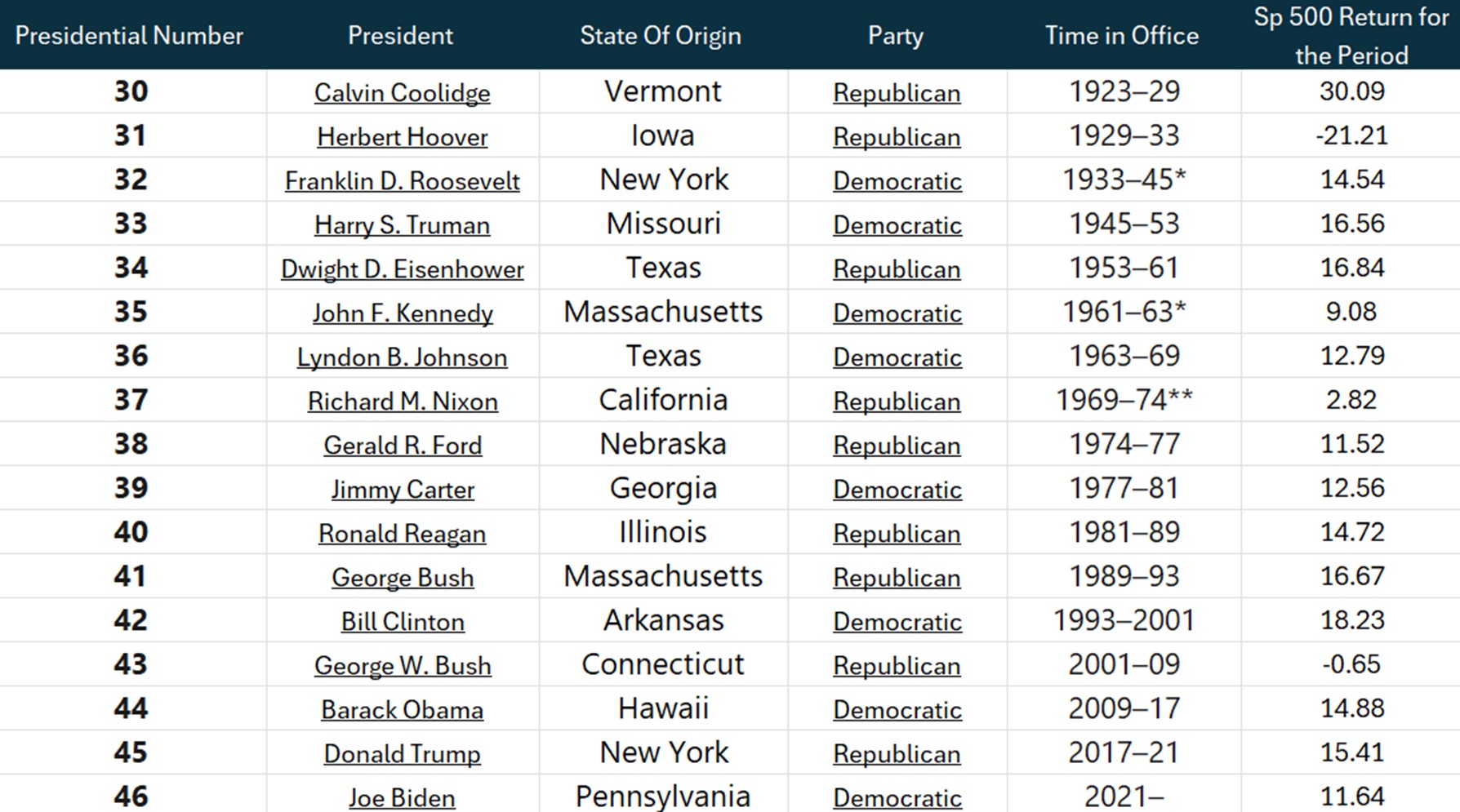

Only 2 of the 17 Presidents since 1926 Presided over negative S&P 500 returns

-

H. Hoover’s term was over 20% negative and G. W. Bush’s term was down 0.65%

-

We believe that the markets, even during election years, are driven by a mix of things that require consideration.

|

It is election season. The news is loud, and it seems like opinions are everywhere while unspun facts are hard to find. Discredit and blame seem to be commonplace in these election races. The media and glitterati are more involved than ever which clouds the issues even further. This has been a particularly interesting cycle given that both sides of the aisle have highly polarizing candidates. Amidst the cacophony of noise, rhetoric, and banter we wanted to see if the markets behave in a discernable way across time, party, and elections. Our goal is to give you some factual food for thought based on actual events. We hope that you glean a few points and they shape how you plan to negotiate this cycle for your family and nest egg.

History of Elections

America wasn’t always just Republicans and Democrats. Several parties came into and out of favor over the years we have been a nation. Federalists, democratic-republicans, Whigs, and national Republicans are some of the now seemingly defunct parties (The Editors of Encyclopedia Britannica, 2017). So historically you must use a broader approach, the simple red versus blue that is popular today if you plan to study the topic. Oddly, even that red and blue convention didn’t always mean Blue for Democrats and Red for Republicans. There have been other colors used throughout time, especially with the advent of television coverage of these contests. (Holland, 2024).

We generally look back to 1926 for SP 500 data (Slickcharts, 2023). Since that time the US has been dominated by the two modern Democratic and Republican parties. There are still other parties and divisions of these parties, but none have occupied the Oval Office since 1926. There have been 9 Republican and 8 Democratic Presidents including President Biden over that period. We have had single and multi-term presidents on both sides. Admittedly presidential terms overlap by a few days as one departs and another sits. For this article and simplicity’s sake, we gave the new sitting president credit for their whole first year. Starting in 1937 Presidents took office on or around January 20th, so we accepted the slight skew in the data. (Writer, 2021)

What We Found:

*We only used 1926 for Mr. Coolidge, and performance to the end of 2023 for Mr. Biden.

*We only used 1926 for Mr. Coolidge, and performance to the end of 2023 for Mr. Biden.

The Better News

Of the 17 seated Presidents considered in this post, 15 had positive returns during their time in power according to our methodology. That is a little better than 88% of the Presidents. These people governed during some of America’s best and worst times. The average return over this whole period was 11.56%. The Republicans spent 47 years in office with an average of 9.57% while the Democrats spent 51 years at an average of 13.79%. Interestingly, Franklin D. Roosevelt (Dem) served only the 4-term reigning from 1933-1945 with a very healthy 14.54% return during his time in office. It does bear mention that he campaigned and won these elections normally albeit during some of America’s darkest days during the Depression and World War II. Following him the 22

nd Amendment curtailed the ability for a more than-term Presidency (Kennedy, 2019). The great depression was contained solely on Republican H. Hoover’s watch and following his term was the single best year of market return since 1926. 1933 had a breathtaking 53.99% S&P 500 return (Slickcharts, 2023). Otherwise, it appears all the President’s average returns have been positive over the measured period.

How to Consider These Data Points

Many modern authors will likely say that the outcome of this Presidential contest doesn’t matter to the markets. We would surely not make that argument. There have been both gut-wrenching bad times and heart-racing great times under both red and blue regimes. In the end, as we say often in this blog, the markets are better than they are worse. Patience and long-sighted planning are the cornerstones of our approach. Legendary financier Paul Volker said in an interview with Ray Dalio that he felt that high policy and rhetoric don’t matter nearly as much as real administration. Paraphrasing a little, I felt his point was that the most important part of any Presidency is what becomes the law during the regime (Dalio, 2022). For example, the Tax Cuts and Jobs Act from 2017 expires shortly after this upcoming election. That is a real piece of law that will really matter and have broad-reaching impacts. I don’t know that the Great Depression was Hoover’s fault per se. I also would not give total credit to Bill Clinton for being the last President to preside over a fiscal surplus. I doubt that Mr. Bush wanted the housing markets to collapse in 2008. It’s our opinion that the Oval Office exacerbates, or improves the circumstances that it finds itself in. We believe that the stock markets run on a confluence of various geopolitical, military, banking, and sector-level comings and goings. At certain times we agree that there are specific drivers, but over-focusing on any one area can easily lead to blindness in others. So, in short, yes, the election matters, but it is not the only thing…that matters. Our approach is to study the policy of these candidates and be ready to shift our thinking as needed once the office is taken even as other market forces express impact. It is not uncommon for the pre-election rhetoric to be very different than what becomes reality in office. We are also paying attention to the major sector-level movements in tech, commodities, and energy as they have been on the move this year.

So, if the elections have you feeling concerned over your family’s situation, we encourage you to examine your beliefs and the current environment. Look ahead to what you feel the most likely outcomes are and plan accordingly. We’d relish the chance to join that discussion. Collection of good data, deliberate action, and close attention are great cornerstones to any investing strategy. If you feel you could benefit from partnering in these fundamentals, please reach out to us.

Sources:

Holland, O. (2024, September 20).

Republicans are red and Democrats blue. But it wasn’t always that way. CNN.

https://www.cnn.com/style/why-republicans-red-democrats-blue/index.html

The Editors of Encyclopedia Britannica. (2017). United States Presidential Election Results. In

Encyclopædia Britannica.

https://www.britannica.com/topic/United-States-Presidential-Election-Results-1788863

Slickcharts. (2023).

S&P 500 Total Returns by Year since 1926. Www.slickcharts.com.

https://www.slickcharts.com/sp500/returns

Writer, L. M. H. S. (2021, January 19).

A look at the long, odd history of Inauguration Day. Harvard Gazette.

https://news.harvard.edu/gazette/story/2021/01/a-look-at-the-long-odd-history-of-inauguration-day/

Kennedy, L. (2019, October 16).

How FDR Became the First—And Only—President to Serve Four Terms. HISTORY.

https://www.history.com/news/fdr-four-term-president-22-amendment

Dalio, R. (2022, August 17).

Ray Dalio & Paul Volcker on How Volcker Broke the Back of Inflation in the 1980’s. YouTube.

https://youtu.be/k50nRM6qUxQ?si=Valcdu-pIv0okMe1

*We only used 1926 for Mr. Coolidge, and performance to the end of 2023 for Mr. Biden.

*We only used 1926 for Mr. Coolidge, and performance to the end of 2023 for Mr. Biden.

*We only used 1926 for Mr. Coolidge, and performance to the end of 2023 for Mr. Biden.

*We only used 1926 for Mr. Coolidge, and performance to the end of 2023 for Mr. Biden.