Chief Conclusion

Clients will begin to see a thoughtful winnowing of our selected holdings in corporate bonds rated less than investment grade. The relentless search for yield has resulted in a dramatic reduction in the premium that investors once earned by taking more credit risk.

The good news is, investors in this lower quality asset class have been rewarded with favorable past returns. The bad news is that going forward a narrowing premium of these yields over U.S. Treasury yields means that future returns may be lower while carrying higher risk. This is an unattractive combination. In fact, the premium that investors now earn for taking this additional credit risk has been lower only 12% of the time since 2000. By selling early while the market is enthusiastically embracing this asset class, we may leave money on the table. However, we believe that the rewards of moving on to new opportunities are worth this risk.

Each industry has its own slang and lingo unique to it. The business of investment research is no exception. When I look back over my near twenty-year career in this business, I find a rich trove of investing lore and pithy sayings. One of the funniest, and most insightful sayings is “Feed the ducks while they are quacking.” This can be loosely translated into English as the much less memorable “remember to sell your investments when they are fully valued and the market is expressing a ravenous demand for them.” The image that most springs to mind is the one below, of a swarm of ducks trampling each other desperately clamoring to be fed. A feathered feeding frenzy!

It’s not just a flock of ducks that can devolve into a mob-like mania of thoughtless imitation. There are many more examples in the animal kingdom. Probably the most visually stunning of these is shown below and takes place in the ocean, where scared fish school together into huge spheres known as bait balls.

This image right shows a swirling school of anchovies reflexively huddled together in a tight orbit for protection. In doing so, however, they make themselves even more vulnerable to their larger and smarter predators. No matter how brutally this school is preyed upon, the remaining fish will continue to form into an ever tighter ball, reacting almost as if the individual fish that made up the school were really just an extension of one larger unit.

This image right shows a swirling school of anchovies reflexively huddled together in a tight orbit for protection. In doing so, however, they make themselves even more vulnerable to their larger and smarter predators. No matter how brutally this school is preyed upon, the remaining fish will continue to form into an ever tighter ball, reacting almost as if the individual fish that made up the school were really just an extension of one larger unit.

Human animals can also descend into this schooling/herding/flocking behavior. This strange attraction, that Bernard Baruch identified, is what causes the endless cycles of fear and greed that drive asset prices in the market. The image below captures the essence of the fevered trading in 1720’s Mississippi Bubble in France, which would go on to be one of the most epic crashes in the history of investing. Maybe we are not as highly evolved and rational as we believe ourselves to be?

One of the major distinctions between human animals and other animals is that our species can use tools to create better outcomes. As investors, we use tools to try to separate our thinking from that of the all-too-often manic crowd. The goal is to make better and more rational decisions.

One of the major distinctions between human animals and other animals is that our species can use tools to create better outcomes. As investors, we use tools to try to separate our thinking from that of the all-too-often manic crowd. The goal is to make better and more rational decisions.

Be Sure That You Are Getting Compensated for the Risks That Your Money Is Taking in the Market

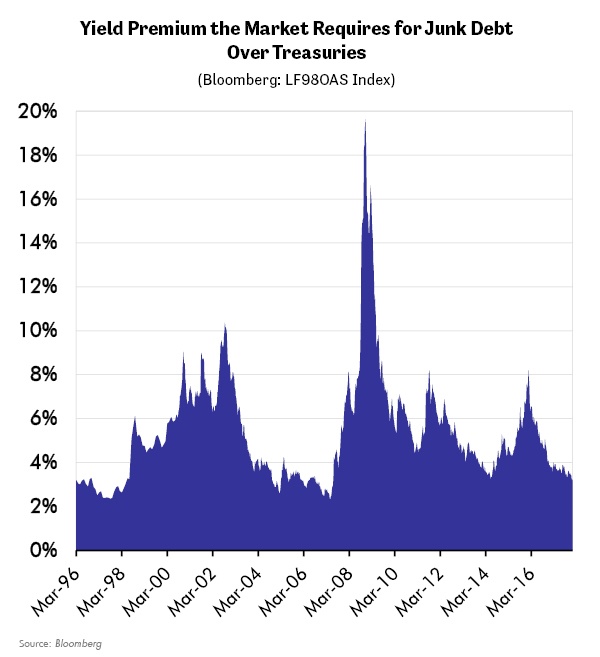

One of the most important disciplines you can develop as an investor is to feed the ducks while they are quacking. We think such a situation may be now developing in the lesser quality corporate bond market, more precisely in the bonds of many companies that are rated less than investment grade. Clients may notice, in the coming days, a measured reduction in their bond portfolios among our ownership of less than investment grade bonds. We are taking this step proactively now with yield spreads over U.S. Treasuries at their lowest in more than ten years. This is another way of saying that an index of these bonds has not been this expensive relative to U.S. Treasuries in ten years. This means that the go-forward returns on such bonds is becoming relatively more unattractive than when we first made these investments.

I Have Good News and I Have Bad News

The good news is that the market has rewarded the owners of less than investment grade bonds. This means that their prices have gone up relative to the price of bonds with less credit risk. This expresses itself in the chart above as a shrinking yield premium over the yields available in the U.S. Treasury bond market. That’s the good news.

The bad news is that this price appreciation has lowered the attractiveness of such bonds going forward. For instance, back in the dark days of the 2008 Global Financial Crisis, bond investors who risked their capital to invest in an index of less than investment grade bonds earned almost a 20% yield premium. So if U.S. Treasury bonds yielded 4%, junk bonds yielded 24%! The market’s fear of a depression drove incredible yield premiums which rewarded bond investors who were willing to take that risk.

That yield premium has now shrunk to 3.17% as of yesterday, 85% less than its peak. Is such a wildly narrowed premium in yields really worth the additional credit risk that comes from loaning money to weaker borrowers? Especially almost 10 years into an upcycle? Our research had already limited our exposure to select bonds that we believed the market had mispriced. Now we are taking an even harder look at this small set of bonds.

One of the goals that this will accomplish is to help the portfolio to be positioned defensively this late into the cycle. The key reason is that down cycles almost always begin in the credit market, in bonds. (See Credit Watching: Exter's Inverted Pyramid at Work and Equity Market Volatility (Finally) Catches Up to Credit Market Volatility)

As cyclical weakness unfolds in bonds, they will become more difficult to sell and, if sold too late, might only be sold at unattractive prices. That’s why we believe this is an excellent time to say goodbye to some holdings among our already select investments. The capital that we raise through the sale of such bonds we will opportunistically deploy into higher quality bonds that will be more resilient in a recession, and select equities that our research identifies as particularly undervalued.

Remember that investing in bonds has a different profile of risk and reward than investing in stocks. A successful outcome in bonds means that you earn interest for lending your money and, at the maturity of the bond, you get your money back. A successful outcome in a stock can make you many times your money as the equity owner of a successful business. We believe that a mix of targeted equity investment and higher quality bonds can be a better way to invest deeper into the cycle of what is now the second longest expansion in U.S. post-war history.

In Conclusion

Often the best path to investing success is not to be brilliant but rather to avoid the most obvious mistakes. The most obvious mistake that we want to avoid is to be overinvested in an asset class that historically appears to be fully priced, particularly when we can sell at the highest prices (most narrow spreads) in more than ten years. We believe this strategy is the most logical way to reach this goal safely, and wanted to use this note to be sure that our clients understood what we were doing and why.

Thankfully, our research team has many tools of fundamental investing to help us make better decisions. As asset prices change, and where we are in the cycle changes, our research is constantly evaluating the most opportunistic investments. We can do this job the most successfully if we sell an asset class when the market is furiously quacking for them and use our research to identify opportunities where the market is aggressively shunning them. This means we have to follow Mr. Buffett’s advice of being fearful when others are greedy and greedy when others are fearful. No one said this would be easy, but it’s a very important part of successful investing.•

Sources:

Duck Frenzy- https://media.mnn.com/assets/images/2015/11/ducks-bread.jpg.653x0_q80_crop-smart.jpg

School of Anchovies- http://www.thesardinerun.info/wp-content/uploads/2016/08/feature18.jpg

Mississippi Bubble- Wikipedia