By LEWIS JOHNSON – Co-Chief Investment Officer | October 19, 2016 “Experience is a jewel, and it had need be so, for it is often purchased at an infinite rate.”

– John D. Rockefeller

? Shakespeare

Invest at the bottom of the cycle and you can profit from a volatile world. Invest at the top of the cycle and even the most well researched, sound, investment may still result in severe loss of capital. Fortunately our study of history – and the example of John D. Rockefeller in particular, gives us important insight into how to navigate this difficult endeavor.

John D. Rockefeller

How did he grow his company to that size and amass such great wealth? He understood three critical things about the oil business: (1) it was cyclical, (2) the low cost producer made the most money and could survive the down cycles and (3) his competitors did not seem to understand numbers one and two. This was his opportunity.

Rockefeller’s competitors allowed themselves to become victims of the business cycle through their own mismanagement: indebting themselves at the wrong times to expand high cost production during the upcycle. Accordingly, he was able to buy their assets at pennies on the dollar in the down cycle when overcapacity was endemic, prices had crashed, and insolvency was everywhere.

Rockefeller had so consolidated the industry that by 1911 the government believed it was necessary to throw the weight of its newly passed anti-trust laws to break up his company. However, even after the break up, the culture of cyclical investing that Rockefeller created lived on in many of the surviving entities. This discipline would enable them to become giants on their own. Many of these companies are well known today including ExxonMobil, Chevron, Marathon Oil, Marathon Petroleum, and other survivors who were ultimately merged into BP: Sohio, Amoco and ARCO.

We think of this today because the oil industry is once again in the midst of one of its periodic cyclical down turns brought about by debt fueled overexpansion at the top of the cycle. Some things never change. Now, a few months off of the most extreme lows in crude oil prices since 1865 (in gold terms), we think it’s prudent to expand upon our initial investment program in energy.

The Discipline of Investing at the Bottom of the Cycle

Since 2014 we have been watching and waiting for an opportunity to invest opportunistically in energy. However, too much excitement was in the air about the “U.S. energy renaissance” for us to be involved. We could see all the classic signs of a debt fueled mania turning into a crash. In fact, one out of every six dollars in the high yield market went to fund energy companies at the peak. Clearly, this was an accident waiting to happen. Our caution was driven by our long experience, as we noted below from our research on crude oil almost two years ago (Crude Oil’s Black Friday, December 3, 2014),

Once again in crude we see more proof of the old adage in commodities: capital destroys returns. Shale oil spending and its related impact have been a huge driving force for the US economy. However, was investing trillions of dollars in some of the world’s highest cost capacity really a good idea? US consumers and others who benefit from falling prices will surely answer with an enthusiastic “yes!” Creditors – and shareholders – of soon to be bankrupt, high-cost and over-indebted shale oil companies may greet these events with a little less enthusiasm.

So we watched and we waited as oil prices, and share prices of energy companies went down – and down – and down. Finally, after a long absence from the energy industry, in early 2016 we believed that it was finally time to begin to invest in this beaten down sector. Three things led us to this conclusion. First, the gold price finally quit falling after its 5 year and near 50% collapse. Gold is a key leading indicator for all commodities, and had stopped falling in early 2016 (The Message of Gold, March 23, 2016). Second, the disastrously low price of crude oil in the $20s could only be sustained if global crude oil demand plummeted 80% from its peak (Remember your Micro to Avoid Investing Mistakes, April 20, 2016). Clearly this was very unlikely. This meant that crude oil prices would have to rise to create the supply needed to fill the world’s demand. Third, the valuation of energy companies had crashed as the cycle did what it always does – overshoot from too high to too low.

We maintained that investing near the bottom of the cycle can be tricky because no one knows for sure when the cycle may turn. Cheap stocks can get cheaper as psychologically beaten-down investors extrapolate the horrors of the prior collapse. We have the comfort of the words of legendary value investor Ben Graham, that while in the short run the market may indeed be a “voting machine” – where sentiment and emotion prevail – in the long run the market is indeed a “weighing machine” – where logic prevails.

This is why we take a pragmatic approach that seeks to build in resilience into our investing. Often it may take longer than we expected for a cycle to turn, as demand growth rises to meet falling supply. This is why our first step in investing in beaten down and cyclically depressed industries begins with low cost producers with balance sheets of pristine quality. We also seek out sustainable dividends that pay us while we wait for the inevitable upcycle to arrive. This discipline gives us multiple ways to win while limiting our downside.

Even if the down cycle proves to endure much longer than we anticipated, such investments should have limited downside. Clients will find examples of such holdings in their portfolio already. Such well capitalized industry leaders tend to be the most resilient should we find that our investments have been made early, a common occurrence when investing in cyclicals near the bottom of the cycle.

Expanding Exposure as Confidence Builds

A number of months have gone by since our foray into energy after our long absence. Several indicators have emerged that have increased our confidence that oil prices have bottomed.

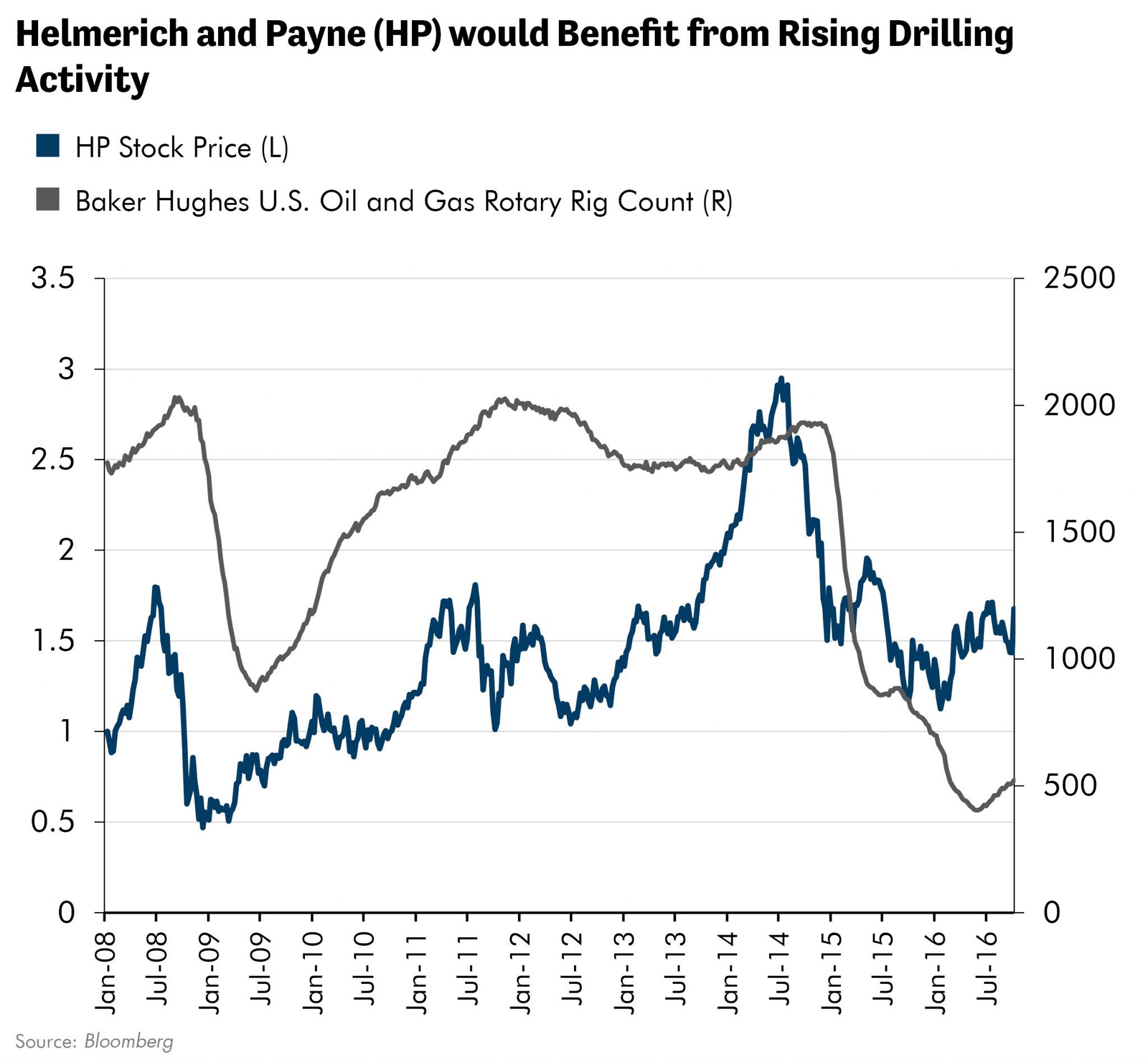

At the time of this publication, the price of oil is holding above $50 per barrel, almost twice its winter lows but still down more than 50% from the prior peak. Importantly, however, this price is still well below the marginal cost of crude oil production and should be stable to higher from here to meet the world’s oil demand. Recently the rig count, a measure of the oil rigs working to produce crude oil, has turned up as well. After sinking to nearly 400 in the spring from a high of nearly 2000, the rig count has rebounded steadily to 540 working rigs.

Beginning to Move Up the Risk Curve

As we gain confidence in the cycle turn we are willing to take on slightly more volatile investments in the energy sector. One way to do this is to invest in the oil services industry, companies that provide the drilling rigs and other equipment needed to find and get crude oil out of the ground. The swings in earnings in these businesses are usually even more cyclical than the price of oil itself. This is reflected in the stock prices of oil services companies being more volatile than the producers. Now, with an epic crash in the U.S. rig count down 80%, we anticipate a period of stable and rising rig counts. This would be great news for the U.S. oil services industry.

Our confidence is growing that certain oil services companies can earn a place in our portfolios. However, as with our earlier energy investments, our discipline is to only own companies that are low cost producers, who have little or no debt, and pay us while we wait through safe dividends. Behind it all, we are seeking to invest with management teams who understand the cycle and have proven adept at navigating previous ones.

Helmerich and Payne (HP) is an excellent example of one such company. HP is a vertically integrated manufacturing and operating business that only builds new rigs when it has profitable long term contracts. Most importantly the long term contracts enable cash flows to be less cyclical. Also, the lower cost of HP’s internally produced rigs and their advanced technology enables the company to have the industry’s highest earnings per rig. Currently the company is trading near the replacement value of its drilling fleet. The company’s 4% dividend yield and near debt-free balance sheet could limit the downside of this investment should the downturn persist.

In Conclusion

John D. Rockefeller made the largest fortune the world has ever known by buying oil businesses at the bottom of the cycle. He did this by understanding the cycle, being a low cost producer, keeping his balance sheet pristine and maintaining access to capital even during the worst of times. This disciplined execution allowed him to confidently buy assets at the bottom of the cycle at distressed valuations. Our own efforts seek to emulate his discipline. It is not easy – but then again nothing worth doing ever is.

Timing the cycle is always challenging. Over the course of our career we have diligently built out a set of indicators that we have come to know and trust to help us in this endeavor. But every cycle is different. Predicting the future is an uncertain task. Thankfully our nearly twenty years of professional investing have taught us a few valuable lessons. When done properly, we can harness the value of these lessons to earn better risk adjusted returns in the market. The pattern is the same. Only the names change.

In 2000 the booming sector was technology, where overly aggressive capital spending led to a crash. In 2008, debt fueled speculation in houses kicked off the Global Financial Crisis. In 2014, it was energy’s turn, where once again a debt funded boom crashed and burned. For watchful and thoughtful investors, the market always presents an opportunity for superior research and insight to find a profitable way forward. The challenge for investors, as always, is to identify and seize upon these opportunities.

–

We would like to thank our experienced consultant Zev Abraham for his valuable contributions to this research.