By LEWIS JOHNSON – Co-Chief Investment Officer | May 18, 2016 “If you don’t own gold, you know neither history nor economics.”

– Blanche DuBois in Tennessee William’s Street Car Named Desire

– Ray Dalio

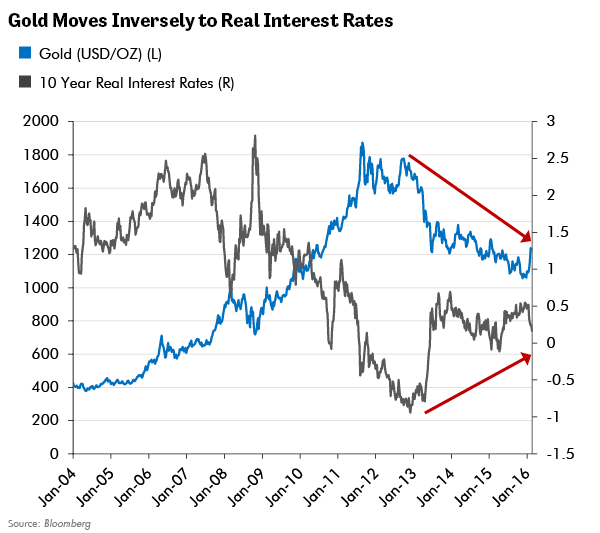

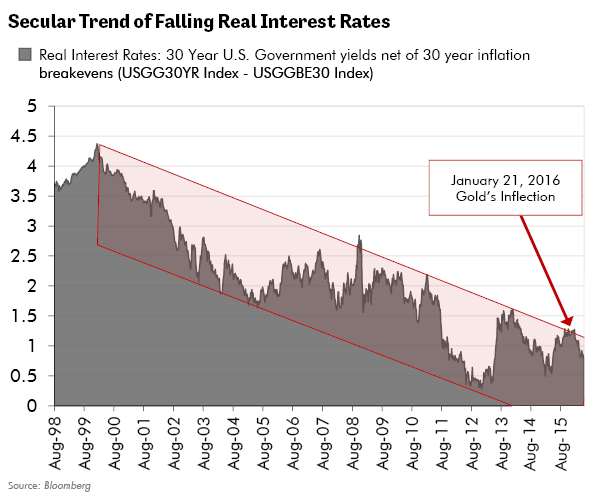

Are both of the trends shown above now reversing? We believe that the answer is yes. If so, the key will be the future direction of real interest rates. The consistent view of this publication for the last two years has been that the secular trend of falling real interest rates would reassert itself, with meaningful implications for the pricing of global assets.

Are both of the trends shown above now reversing? We believe that the answer is yes. If so, the key will be the future direction of real interest rates. The consistent view of this publication for the last two years has been that the secular trend of falling real interest rates would reassert itself, with meaningful implications for the pricing of global assets.

Nonetheless, while we waited for the market to validate this conclusion, we were still able to find isolated pockets of value. We heeded the counsel of both Keynes and Falstaff to exercise both patience and discretion. Our strategy has always been to understand the causality that drives markets. Accordingly our focus was on identifying why rising real interest rates would prove self-defeating in an overindebted world. Our view was that dollar strength and higher real interest rates, given the world’s overwhelming debt load, would lead to economic weakness. Accordingly, we positioned our investments in higher-quality, longer dated bonds and defensive equities. The endgame, our goal, was to remain patient and ready for the turn in gold. Events underway today have all the hallmarks of that turn.

Nonetheless, while we waited for the market to validate this conclusion, we were still able to find isolated pockets of value. We heeded the counsel of both Keynes and Falstaff to exercise both patience and discretion. Our strategy has always been to understand the causality that drives markets. Accordingly our focus was on identifying why rising real interest rates would prove self-defeating in an overindebted world. Our view was that dollar strength and higher real interest rates, given the world’s overwhelming debt load, would lead to economic weakness. Accordingly, we positioned our investments in higher-quality, longer dated bonds and defensive equities. The endgame, our goal, was to remain patient and ready for the turn in gold. Events underway today have all the hallmarks of that turn.

Much of our outperformance during this time can be attributed to a simple insight, which is now much less controversial given the passage of time, that this is not a normal economic or market cycle. The world is too indebted for that. Markets are now starting to validate our long-held concern that decades of Fed policy encouraging debt growth have led to global over-indebtedness that actually hurts long-term growth prospects even if it might stabilize the markets in the short-term. This is a profound and powerful insight indeed for the markets to digest. No asset class will remain unaffected.

Getting to this point has been a frustrating – but nonetheless profitable – time for us to invest. At the core of the struggle lay the paradox at which we could only hint in such notes as “Navigating Orwellian Markets, January 27, 2016,” published appropriately enough in retrospect only days after the price of gold began rallying in dollars. The paradox was the mental gymnastics required to “doublethink” our way through a market that had gotten real interest rates completely wrong yet still punished gold – for a crime (rising real rates) that never happened! It’s no exaggeration to say that navigating this gap between reality and what “ought to be,” which has persisted for years, has been one of the most challenging investment environments we have encountered in our career.

Interestingly, the market’s gradual and grudging acceptance of our views has made possible pockets of profitable investment: such as the value in high quality, long duration bonds, or the value in strongly defensive, branded consumer stocks with sustainable dividends. Now (finally!) what is perhaps the most undervalued asset on the planet has moved front and center: gold.

For a full five years this Blanche DuBois market mispriced gold – not based on truth but on what it thought ought to be the truth. This completely disappointed expectation that higher rates were just around the corner, took gold down a full 48% over a consecutive five year period. This devastation claimed the career of many investors who could not find a way forward in these markets.

In retrospect, however, the evidence is incontrovertible: expectations for Fed interest rate hikes were too aggressive. Expectations for the path and height of real interest rates were too aggressive. Gold suffered for no real reason, not based upon truth but upon what the market believed ought to be true. In January that all changed – maybe for a long time. If this is indeed the case, then the opportunities for profitable disagreements with the market are now more dramatic than perhaps at any time in the last fifteen years.

A Trend Change in Gold Matters to Many Assets

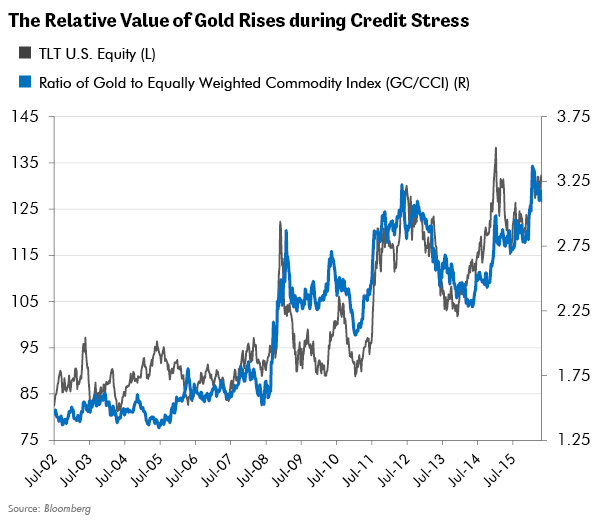

We have noted time and again the incredible importance of the information that flows from gold’s price signals. The gold market contains information relevant to emerging markets and commodities (The Message of Gold, March 23, 2016) and the corporate bond markets (Is Credit Quality Peaking, August 6, 2014). In fact, the relative value of gold, shown below as the ratio of the gold price to the price of the equal weighted commodity index, even contains information relevant to the price of the longest dated U.S. Treasury bond, shown below as the TLT ETF. A change in trend in gold prices, from down to up, can be a world changing event for these asset classes.

A Different Kind of Gold Bull Market?

A Different Kind of Gold Bull Market?

It’s possible that this market will confront investors with a different kind of gold and commodity bull market, one not driven by growth, or China, but rather by falling real interest rates. While confusing to most, this should present a rich opportunity set for those who understand this particular cycle and its drivers.

We suspect that this new environment could be the result of the dawning reality that no market on the planet can sustain high and rising real interest rates. At such high levels of debt, we should expect neither a resumption of “normal” growth nor sustainably high real interest rates. Central banks may find themselves trapped into providing easy money and continued unconventional stimulus.

Gold no longer has any natural predators, no Paul Volcker waiting in the wings to crush it with 20% short term interest rates. Given the slowly dawning permanence of an ever more stimulative monetary policy, who can say how high gold prices may rise? It has been our experience that it is unwise to underestimate the strength of newly-unfolding bull markets while they are in their infancy. Rather we should err on the side of thinking expansively, although never underestimating the volatility with which such cycles tend to unfold.

Through any kind of market, we always believe in the benefits of owning thoroughly researched investments in a diversified portfolio. What we cannot control is the richness of the opportunity set. For that we are reliant upon the market to make a mistake, and the bigger the mistake is, the better! But Keynes knew that investors had to survive and make it to the turn if they were to profit from those mistakes. We believe that now may be just such a time.

In Conclusion

We, and a handful of investors who we believe do thoughtful work, have argued since 2008’s Global Financial Crisis that the economic and investing landscape would make this a different kind of cycle. Consensus opinion indulged in “magical” thinking: choosing to hope in what “ought to be true,” eager to believe that nothing had really changed.

Have eight years of continuously disappointing economic performance, interest rates pegged near zero – and in some cases negative – created a crescendo too loud to ignore? We believe the past few months, particularly the extreme market revulsion to one tiny Fed interest rate increase in December, has brought home the realization that things may never go back to “normal.” If true, this will have implications for all asset classes but particularly gold, the asset that is most sensitive to falling real interest rates, prolonged slow growth, and the inevitable policy response to it.

We would like to gratefully acknowledge the welcome contributions of Zev Abraham, our highly experienced analyst, in this week’s Trends and Tail Risks.

CWA Asset Management Group, LLC is a SEC registered investment adviser, doing business as Capital Wealth Advisors and as blueharbor wealth advisors. Fundamental Global Investors, LLC is a SEC registered investment adviser that is affiliated with CWA Asset Management Group, LLC. Information presented is for education purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Nothing herein should be interpreted as investment advice. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Such case studies are not meant to be, and may not be, representative of any portfolio or holdings of CWA Asset Management Group, LLC, or Fundamental Global Investors, LLC.

Please note that past performance is not indicative of future results.

This material is solely for informational purposes and is intended only for the named recipient. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision.