By LEWIS JOHNSON – Co-Chief Investment Officer | June 11, 2014

Investing is an exercise in decision making under uncertainty. We use a variety of tools to minimize uncertainty and increase the odds that our investments are successful. One of the most important tools is valuation, the act of calculating what a company is worth. When our estimates of value differ greatly from the prices in the market, we tend to get very excited! Replacement cost is one of our most helpful valuation tools, especially when valuing companies in cyclical or commodity sensitive sectors. This week’s Trends and Tail Risks explains how we use replacement cost to value companies.

Replacement Cost

We use replacement cost as one of the first steps in our valuation process for a number of reasons: it is simple, can be done fairly quickly, and asks all the right questions we need to answer should an idea appear attractive enough for further analysis. We begin by calculating the cost necessary to replace the production capacity of a company and compare that value to how the market values that same asset base. This is an important first step in our valuation work because we need a baseline valuation we can trust.

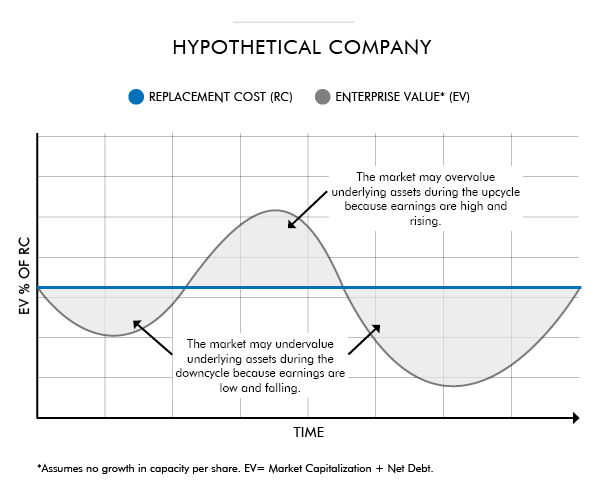

We have learned from experience to simplify our thinking, focusing on the truth that companies are really just a basket of assets moving through time. Earnings rise in the upcycle, not because the asset base somehow magically changes, but rather because during the upcycle the asset base is more fully utilized at higher margins. Earnings fall during the downcycle because the same asset base has passed through the peak of the cycle and is now headed back toward a cyclical trough, with lower operating rates and lower margins. The enterprise value (market capitalization + net debt) may change quickly as the cycle changes but a company’s asset base changes slowly. Replacement cost valuation helps us ask the two most important – yet totally distinct – questions of our investment analysis: (1) what are the underlying assets worth, and (2) where are we in the cycle?

We have learned from experience to simplify our thinking, focusing on the truth that companies are really just a basket of assets moving through time. Earnings rise in the upcycle, not because the asset base somehow magically changes, but rather because during the upcycle the asset base is more fully utilized at higher margins. Earnings fall during the downcycle because the same asset base has passed through the peak of the cycle and is now headed back toward a cyclical trough, with lower operating rates and lower margins. The enterprise value (market capitalization + net debt) may change quickly as the cycle changes but a company’s asset base changes slowly. Replacement cost valuation helps us ask the two most important – yet totally distinct – questions of our investment analysis: (1) what are the underlying assets worth, and (2) where are we in the cycle?

Price is What You Pay, Value is What You Get

Replacement cost valuation allows us to detach our estimates of value from the near term noise that can so easily dominate other valuation techniques. In fact, we find that the best values occur when the current news is horrendous and the cycle is depressed. We happily trade ‘near term visibility’ for a deeply discounted entry price if we believe it reflects all (or better yet more than all) of a sector’s cyclical woes. There are costs of trading visibility for value; longer holding periods and cheap stocks could get cheaper. However it has been our experience that such patience is often overwhelmingly rewarded.

We will devote future editions of Trends and Tail Risks to how we estimate replacement cost, identify superior management teams, think about where we are in the cycle, and develop conviction in our best ideas. Our goal is to make our investors’ money grow while sharing with you not only what we are watching in the markets, but also explaining the way we allocate capital. As always we welcome your feedback and comments.

CWA Asset Management Group, LLC is a registered Investment Adviser. Information presented is for education purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Nothing herein should be interpreted as investment advice. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Such case studies are not meant to be, and may not be, representative of any portfolio or holdings of CWA Asset Management Group, LLC.

This material is solely for informational purposes and is intended only for the named recipient. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision.