By LEWIS JOHNSON – Co-Chief Investment Officer | November 3, 2016 “Nothing is as popular nowadays as hatred for “popular” politicians.” One way or another, thankfully, the U.S. Presidential election will be over next week. Few will mourn its passing. This campaign has revealed the U.S. to be divided by some of the most bitter partisanship since the run up to the U.S. Civil War, more than 150 years ago. And make no mistake, this trend is not just expressing itself here in the U.S. Voters globally are lashing out angrily at “popular politicians.” The center has failed. Traditional, centrist politicians have lost credibility to the more strident voices on the left and the right who have not yet had the chance to disappoint today’s frustrated voters. This is clearest in Europe, where the endemic problems of low growth and unemployment are far worse than here in the States; and where these troubles are compounded by the deluge of immigrants fleeing the collapse of war-torn failed states in Africa and the Middle East. The turmoil of “Brexit,” of Britain voting to leave the European Union in June, was only the latest and most visible sign that voters are “mad as hell and not going to take it anymore.” Change is coming. Indeed, change is already here. This publication does not have a dog in that hunt. Ours is not the burden of making policy or opining on what is “best” for the country or for the world. Our singular charge as fiduciaries is to seek to find a profitable way forward, regardless of the outcome. In the paragraphs to follow, we outline the unanticipated investment consequences of the dominant trend gripping the world right now: de-globalization. One discussion we have had many times as an analytical and research team is how eerily similar to the Global Financial Crisis we find the pre and post-Brexit periods of market trading. During the financial crisis, the trend would progress in fits and starts. Long periods of quiet would be shattered by explosive price action as the new trend revealed its shocking power, only to be followed again by a seemingly interminable period of calm, but things were not calm – far from it. Pressure was constantly building as the trend grew in power, unrecognized. Investing during this period was a real challenge. The circumstances above demanded laser-like focus on the most important issue of the day, joined with incredible patience and a willingness to underperform, in the short run anyway, to preserve capital in the long run. During the financial crisis, the cancer sweeping the markets was that of a credit contagion blazing through a world of unprecedented inter-connectivity. Now, the trend is one of populism and its corollary, de-globalization, but make no mistake, its power to wreak havoc in the most globalized economy in history is not any less intense.

– Cicero’s Letters to Atticus

?Cicero’s Letters to AtticusBrexit as Prelude to De-Globalization

Many such important questions will be important to the future course of the markets. And what about other important questions too: such as the fate of trade-dependent emerging markets whose industrialization took place thanks to our current open-trading system? Today there is no shortage of important questions to ponder.

Voters in the U.K. and the U.S. can disentangle themselves from a highly globalized economy with a smaller negative impact than almost any other country in the world. We both have central banks that “manage” (and I use this term loosely) our independent currencies. Both have central banks joined at the hip and accustomed to working hand-in-glove with the nation’s treasury powers to develop coordinated policy responses. Look no further for evidence of this than the dramatic outperformance of the UK and U.S. economies after the Global Financial Crisis versus those of continental Europe.

The greatest irony is this: Brexit, the world’s most prominent example of de-globalization (so far) is an example that almost no other nation in the European Union can follow. Its “success” is highly unlikely to be shared by other countries that seek to follow its path. If, as we suspect, the trend of populism and de-globalization continues to spread in Europe, both voters and investors may find themselves dealing with exceptionally powerful and negative unintended consequences.

Italy: The Next Shoe to Drop in Europe?

After the U.S. election next week, all eyes will likely turn to the next nexus of global populism and de-globalization: Italy. In little more than a month Italian voters will take to the polls to vote on a series of proposed constitutional changes. Matteo Renzi, the fourth Prime Minister of Italy in the last four years, has stated that he will resign if his reform package does not pass. This seems increasingly likely.

Italy’s economy is a basket case. Unemployment is close to 11% with youth unemployment much higher than that. The economy is not growing. Many of Italy’s largest banks have lost 50-95% percent of their market value in the last eighteen months as shareholders lose confidence. The opposition “Five Star” party is gaining momentum. Its leaders are calling for a “Brexit like” referendum on the European Union. This could entail far more lasting damage to Italy and its financial system than almost anyone anticipates. The more relevant example for Italy is not Brexit and the U.K. – its Greece.

Frequent readers will realize that this is a theme about which we have been writing since mid-2014 (“Big Problems Start Small” May 21, 2014), when we first chronicled our concerns about this toxic combination in Greece. Since then our worst fears have become true as Greek banks have lost 99.99% of their value. When banks suffer, the economies that depend upon them for capital suffer too. Greece has suffered from a Depression longer and deeper than that of the Great Depression. We view Greece, not the U.K., as the more likely precedent for a “Brexit” situation in Italy.

Watch the Banks

Before the Brexit vote took place, we published research that outlined what we thought were the real consequences of Brexit (“Brexit: All Eyes on European Banks” June 15, 2016). The market chose to ignore these risks before the event, then moved to price them in with a speed and intensity that can only be described as stunning. Some of the largest banks in continental Europe opened down more than 30% on the morning following the British vote. This was a surprise to many but should not have come as a surprise to those who were following our research. Below we excerpt a lengthy quote from this piece:

Furthermore, the EU’s fragile financial system of massively overleveraged banks is choking on cross-border liabilities from other banks in a way that almost no one can truly quantify and even fewer understand. Further complicating this issue, the governments that have borrowed in Euros are not free to print Euros to backstop their own banks. Our concern is that this terrible flaw could spread far beyond the limited and understandable issues that divide Britain’s voters. As we have argued many times (“Is Spain the Next Greece?” June 1st, 2016), those countries with currencies pegged to the Euro are most at risk from its design flaws – Spain, Italy, and France, just to name a few. But the debts of these countries’ banks to other banks, and frankly the debts of those banks to others, create the preconditions of systemic weakness not seen since the days after Lehman Brothers failed.

After a few post-Brexit days of sheer terror, the market chose to let its fears subside. This was the same pattern it followed during the global financial crisis: brief moments of terror followed by long weeks of calm. Will the relative peace since Brexit continue? Or would more evidence of the growing trend of de-globalization, such as a Trump win in the U.S. or a vote against Italy’s referendum in December, shock the markets out of their complacency? Much is riding on that answer.

Bullish Consensus Opinion on the Largest, Most Complex Global Banks (Especially Those in Europe) may be Misplaced

If, as I suspect, the unfolding trend of populism and de-globalization should intensify in the days to come, then we should look to Italy and to the world’s biggest banks as those with the most to lose.

European banks have literally trillions of dollars of exposure that we can see, and many trillions more that reside unseen in their derivative books, once called by Warren Buffett “weapons of mass destruction.” Months ago, we took the necessary precautionary steps to limit our exposure to this industry.

Many of these very banks are supported right now by the talking heads on CNBC and other sources that pass for financial “news.” Current enthusiasm for these stocks is driven by an unwavering fixation on the Fed’s unfolding strategy of raising U.S. interest rates, which is widely expected to accelerate and thus improve bank earnings. We understand the logic of this view but believe that those solely fixated upon this thesis may miss the risks posed by de-globalization.

The banks in continental Europe are the most at risk. To be more precise, those most dangerously exposed are headquartered in countries that borrow in a currency that they are not allowed to print: the Euro. This is where Italy comes in, its risk compounded further by the looming referendum on December 4th.

In Conclusion

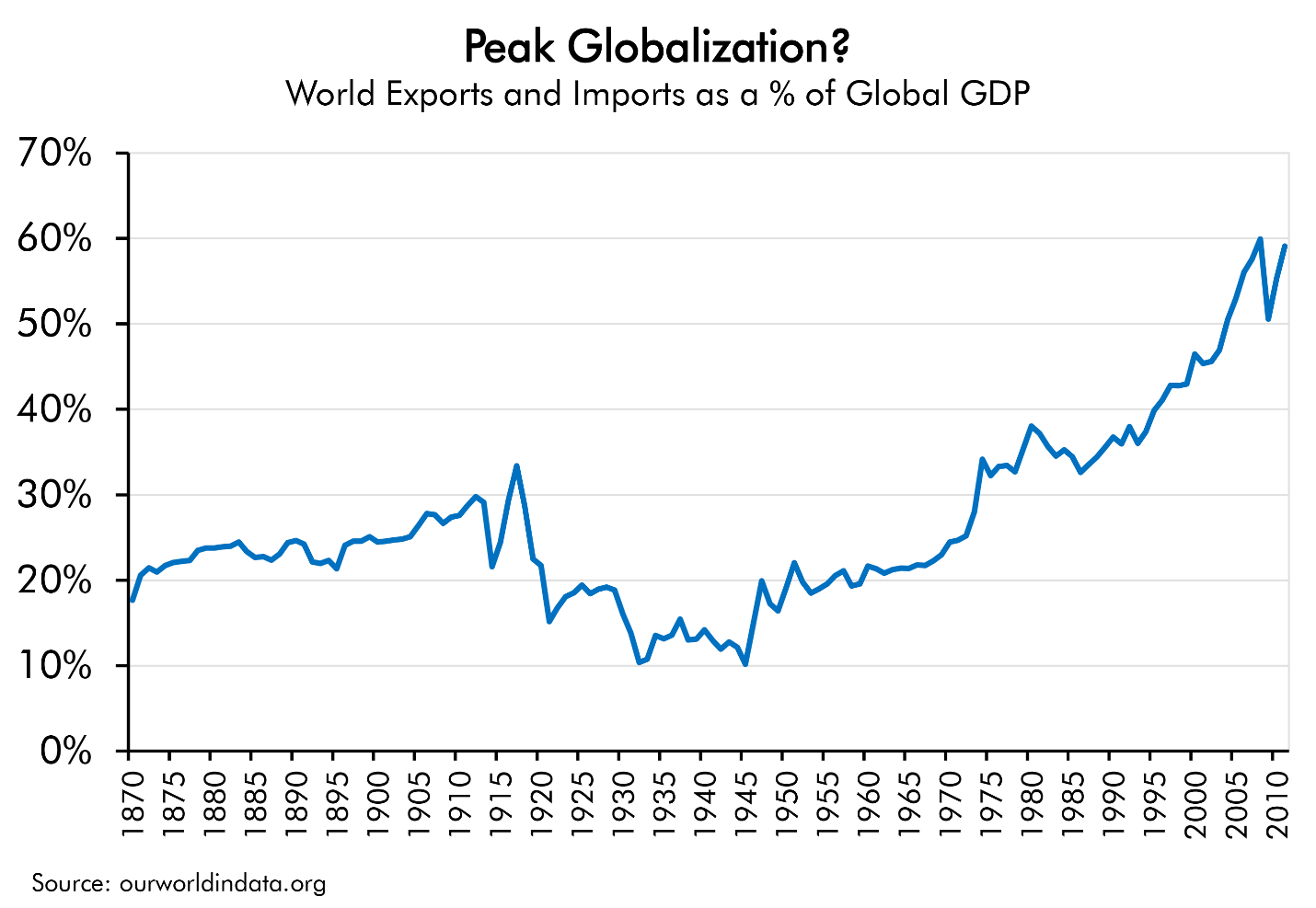

Sometimes in investing the hardest thing to do is to think expansively enough at the start of a powerful trend. Globalization has been the dominant theme since the end of World War II, literally for two full generations. Is this trend really ending? If so, then even the most open-minded of thinkers will be taxed to chart a clear way forward. The U.S. Presidential election and Italy’s upcoming referendum will be important signposts along the way. Our studies of market history have long drawn us to the 1930s, the only prior time, outside of the World Wars, when globalization shrank. The precedent is not inspiring.

What other changes might accompany this new trend that others have not yet currently anticipated? What risks would they pose? What opportunities would they reveal? Our analytical team’s research effort is devoted to thinking through these developments prospectively, since what matters most in the markets is not where we came from but rather where we are going. We are devoted to identifying the defining trends of our time and matching this knowledge with the best investments with which to capitalize upon those trends.