By LEWIS JOHNSON – Co-Chief Investment Officer | August 25, 2016 “A man on a thousand mile walk has to forget his goal and say to himself every morning, ‘Today I’m going to cover twenty-five miles and then rest up and sleep.”

– Euripedes

– Leo Tolstoy, War and Peace

The Incredible Vanishing Real Return

Many investors own AAA bonds because of the perceived safety of their bond principal. These investors’ goals are not high income but rather safety of principal with modest income. Our bond strategy for the last two years has harvested capital gains from appreciating higher-quality and longer duration bond prices as the reality of a slower-growth world has been grudgingly embraced by the market. This controversial stance has led to strong returns – while exposing capital to less risk – the Holy Grail of investing (“Our Bond Strategy: The Power of Duration,” October 8, 2014).

The way this has worked is simple: as expectations for future real returns fall, investors have been willing to pay a higher price for the longest dated – and highest quality income stream. Investors who correctly acted upon this insight two years ago have not only locked in yields on which today’s beleaguered investors can only look upon with envy, but also are sitting on capital gains as high as 20-40% depending on the bond.

What could be better than this? What if we could find a way forward in this strange new world of investing that would mirror the dependability of these bonds, yet also hold out the prospect for growing dividends over time? Now that is something that would have our full attention! We believe that this solution exists in our world – if investors exercise extreme rigor in their thinking and can choose wisely from among the world’s highest quality companies. In our low real growth world, we think of such equity investments as “AAAA bonds.”

A Valuable Investment in a Low Return World

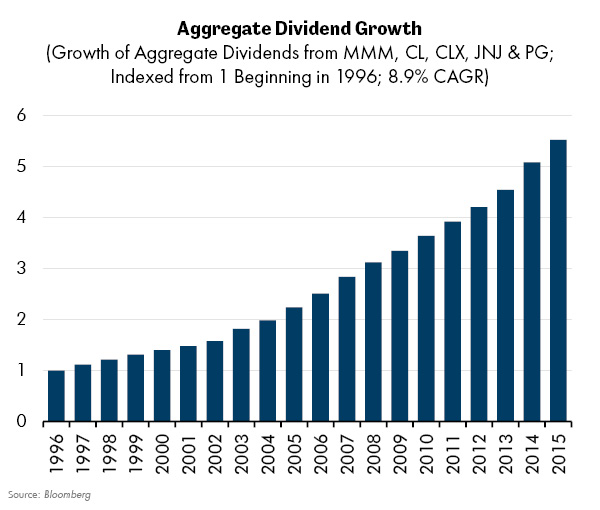

Our nearly twenty years of professional investing experience and ongoing work of our research team enable us to always be on the lookout for companies that we believe fit this profile. It is a small list. Today we choose to highlight a few of these in Colgate Palmolive (CL), 3M (MMM), Johnson & Johnson (JNJ), Proctor & Gamble (PG), and Clorox (CLX).

These are household names with which many investors are no doubt familiar. What makes these companies special? Their uncommonly high and, we believe, sustainable returns on capital that power excess free cash flow that may reward shareholders with growing dividends. Each stock has its own unique dynamic, from Colgate’s dominance of the prosaic toothpaste business to 3M’s incredibly innovative product offerings.

What they all share is a strong competitive position that we believe can help them defend very attractive returns from the horde of jealous competitors that would dearly love to earn such returns themselves. Lots of companies can – temporarily – earn a high return. Such companies may benefit from a fad-driven boom (think today’s bizarre Pokemon craze – remember the Beanie Babies?), a temporary cyclical acceleration and peak earnings (think energy in 2014 or technology in 2000) or for a whole litany of reasons prove unable to defend their world-beating returns.

Frankly, this all too familiar description of transient profits fits perhaps 99.9% of the companies in the investing world. The world is so filled with such companies that the majority of this publication’s pages have been devoted to the folly-driven cycles of boom and bust that drive so many of the world’s companies. These cycles serve up a never-ending feast of opportunities as valuations crash below intrinsic value in the bust or shoot far above anything that is remotely sustainable during the frenzy of the boom. We are not afraid to pick our spots in such cycles (“Old Friends: Kirby Corporation (KEX),” July 27, 2016). However, long experience has taught us the benefit of patiently owning world-class companies that are the most resistant to the pressures of such cycles.

The Key is Always Owning the Right Thing – at the Right Time

So there are two mutually exclusive but important determinations when investing in these companies: 1.) which companies have truly the most sustainable returns and 2.) when to own these equities. Investors who answer both these questions correctly will earn the best returns.

Those fit the profile of companies that we think can add growth to a portfolio while sacrificing very little safety. Keep in mind, that while the coupons for the AAA bonds are fixed and cannot grow, the dividends of these companies offer the prospect of consistent growth, such as our examples named above have been able to demonstrate over time.

These investments have done the best for their shareholders during challenging times when growth is low and uncertainty is high – which sounds a lot like today doesn’t it?

These investments have done the best for their shareholders during challenging times when growth is low and uncertainty is high – which sounds a lot like today doesn’t it?

Consistent Growers Deliver

Why do we have confidence that such companies can sustain the cash generation needed to fund the dividend growth above? We strongly believe that our research has identified companies who can deliver growth in challenging times.

Our belief in their future is also buttressed by their achievements in the past. The years since the 2007 peak have not been kind to corporate revenues and profits in the general economy. Nonetheless, these companies have grown consistently and honestly, without leverage tricks or fancy accounting games.

These consistent growers can generate strong returns for investors. However, this does not mean they are always the best investments. Frankly, we would be far less interested in owning them if we believed that the economy could grow more quickly. We have gone on record many times stating our belief that our central bankers’ policy errors, and the overindebtedness that they have fostered, will be our burden to bear for many sad years (“False Narrative: The Myth of the All Powerful Central Banks,” December 17, 2014, “Fed Rate Hikes are a Mistake,” February 24, 2016).

Our research team continues to identify a growing but small number of industries where we believe we can find underpriced sustainable growth, and rifle-shot cyclical opportunities where fate has conspired to darken an industry’s prospects, creating compelling valuation opportunities for those who can see a brighter tomorrow. These pages will continue to outline such opportunities as we uncover them.

In Conclusion

Finding the right balance in investing is one of the principal dilemmas investors face: equities versus fixed income, risk versus reward, growth versus value, current yield versus retained reinvestment are all questions that must be answered. As times change, prices change. Cycles ebb and flow. Accordingly, so do prospective returns and the opportunity set that lies before us. We outline this changing investment panorama in these pages.

What does not change is our goal of preserving and growing the capital entrusted to us. We believe that global over-indebtedness will weigh upon the market’s real growth prospects for many years to come. Such a period, however, should reward investors who properly identified this environment and solved the riddle of balancing opportunistic cyclical investing with the patient ownership of the highest quality companies.

We would like to gratefully acknowledge the welcome contributions of Zev Abraham, our highly experienced analyst, in this week’s Trends and Tail Risks.