Chief Conclusion

Wouldn’t it be nice to have the confidence that you could pick up the phone and get a straight answer from a trusted expert? We have been working for our entire career to make that a reality through building a trusted network of contacts. Why? The best research tool is a deep network of smart, insightful people who are willing to share their knowledge with you. How to tap into this powerful resource? First you have to identify who really knows what they are talking about. Then you have to prove that you can add value to them so that they will pick up the phone when you call. No matter how talented you may be individually, your investment research effort will always be inferior if you do not have a global network to draw upon. As a case study, we examine today’s investment opportunities in the shipping industry.

This publication began its life more than three years ago as a communication directly to our existing clients about the logic behind the investments in their portfolio and the opportunities and threats we were identifying in the markets. Our goal was to help clients see the world through our own eyes. The hope was that, in doing so, clients would better understand their investments and hold them more patiently, which is critical for our shared long-term success. We also sought to help clients understand the research tools that we used to reach these conclusions.

Along the way this publication has grown beyond our client base and now reaches several thousand readers. Many of these readers are in the business of investment research and hail from 35 different countries. Other readers are long-time friends who we have met on our journey of shepherding capital through the investment markets. I consider many of these individuals to be the world’s premier experts in their chosen fields. They include portfolio managers, company CEOs, entrepreneurs, and other individuals whose insights I have learned to value during my near twenty year career in investment research.

Words cannot express how valuable I find the collection of their individual wisdom and insight. Some of them I have mentored. Others have mentored me. Each of them has taught me to understand investments that I would never have found without them. For all of their contributions I will be forever grateful.

One of the unexpected benefits of writing Trends and Tail Risks is to allow me to return the favor by adding value to these professionals’ own efforts. After all, how could I expect these busy and successful people to pick up the phone when I call if I were not providing value in equal measure to the valuable time that they so generously shared with me? I am calling them because I respect their insight and need an answer I can trust. But they must, in turn, trust and respect me. Is this not the way the world works?

In today’s Trends and Tail Risks, we want to share with you an example that demonstrates why we believe that the most powerful research tool we have is not limited to our own experience, or even that of our growing research staff, but rather the knowledge of our network of professionals who are willing to share their insights with us.

The Decade Long Collapse in the Shipping Industry Creates an Investment Opportunity

Fifteen years ago on a research trip to China I met an impressive young analyst whose specialty was the shipping industry, especially the dry bulk freight market that was so critical to so many commodities in which I was interested. I already had billions of dollars invested in the equities of commodity producers, and had studied them and their prospects for years, so I was able to judge the quality of his work and insights instantly – both were superb. Even better, I was uniquely positioned to add value to his own research, just as he was uniquely positioned to add value to mine. Thus began a long and successful informal collaboration that continues to this day.

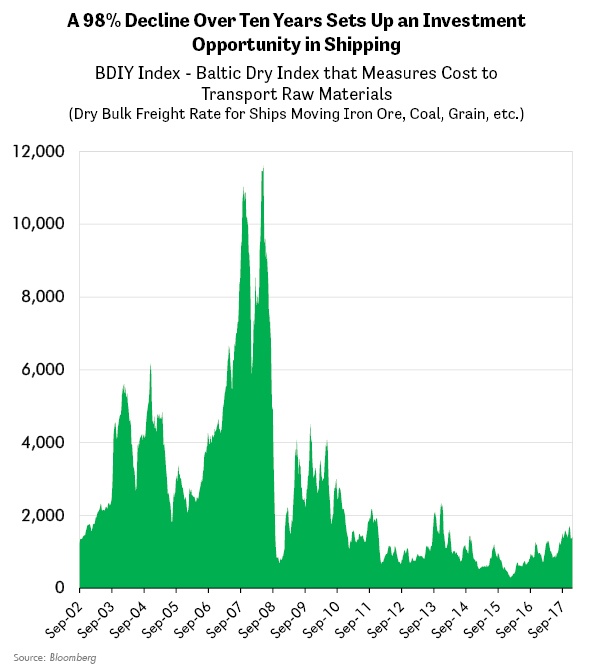

As the chart below demonstrates, over the next fifteen years there would be a lot to discuss! The initial seven fold boom in freight rates from 2003 to 2007 was followed by an epic, decade-long collapse of 98%. Through both booms and busts, I found that the quality of his insight never flagged.

During this time, my friend’s career would take him all over the world, culminating in a leadership role operating one of the world’s largest fleets of more than 200 ships at one of the world’s largest commodity trading companies. My friend has forgotten more about shipping than almost anyone else will ever know.

It’s Who You Know That Counts

A recent discussion we had especially piqued my interest. We were both, of course, intimately aware of the incredible depth of the collapse in shipping rates. As a value investor, I had been rooting around the wreckage of the shipping industry for the past few months looking for something to buy.

Long-time readers will know our framework is to seek out companies that trade for less than the replacement cost of their assets, which only takes place during times of almost unprecedented industrial distress. The temporary undervaluation of assets in distress can provide a wonderful beginning for a future investment campaign.

What was new about our discussion was his perspective that changing regulations in the shipping industry could disrupt the industry’s supply/demand balance in unexpected ways. I take very seriously his musings about what the future may hold for his area of expertise because of my long history with him. So I dug more deeply into the fundamentals of shipping.

Disruptive Regulations are coming: This Could Give Shipping Investors Multiple Ways to Win

The two changes he noted are global environmental standards sponsored by the International Maritime Organization. The first is the “Ballast Water Management Convention” that went into force late last year. It requires that newly built ships have waste-water treatment equipment that purifies ballast water to certain minimum levels. After September 2019, ships that were built before these standards came into force will need a costly upgrade to their equipment to meet this standard for the vessels to pass their periodic inspections.

The second standard will be implemented in 2020. I was amazed to learn that the world’s biggest 25 ships emit more sulfur than the entire world’s fleet of cars! Accordingly, the regulation’s goal is to limit this pollution. Ship-owners must achieve this goal and have several ways to do so, such as retooling to switch to a less polluting fuel like gas or methanol or by installing scrubbers to lower concentrations of pollutants.

Change Can be a Good Thing for Investors: If You Own Cheap Assets with Staying Power

If freight rates do not rise with the investment required to build new ships, then there is little economic incentive for many ship-owners to spend the additional capital required to meet the new regulations. This short term squeeze on shipping economics could prompt an increase in vessel scrapping as older ships are retired from service and less new supply is forthcoming from shipbuilders, who are already under pressure from the collapse in freight rates. Any force that constrains supply relative to demand should be positive for freight rates and, in time, the economics of shipping. One unintended consequence of these regulatory changes could be a surprisingly strong bull market in shipping costs!

It is not clear how this situation will resolve itself. One thing seems evident, however: these regulations could put an additional strain on the already limited quantity of ships available that can meet these standards. Remember that this additional burden comes after a 98% decline in freight rates which not only crushed shipping companies, but also destroyed the economics of companies that make ships, pushing many shipbuilders into bankruptcy. Such a long history of horrible returns has starved the industry of capital and therefore set up the pre-conditions for a potential upcycle should demand for shipping capacity grow relative to supply. This uncertainty could lead to even more supply constraints in the shipping industry, which would be favorable for freight rates and those who would profit from their increase.

In Conclusion

We believe that tapping into an extensive network of world experts whom we trust, and who will share their insights with us, can help us identify powerful trends in their infancy. There is no substitute for knowing the right people who are immersed in the details of the industries in which we are invested. The key is that you have to know who to trust – and they have to trust you! The best basis for trust is a long, shared history of respect and reciprocity where the act of sharing is not a one way transaction but is rather mutually beneficial. That’s why we think our most valuable research tool is the network that we have built over the last twenty years. It’s who you know that counts!

No one knows the future. Nevertheless, thoughtful investors can skew the odds in their favor. The best way is to use the insights of your network to identify undervalued assets in industries that are changing rapidly, especially when the economics of the industry have already collapsed to unimaginable depths. This undervaluation limits the downside that investors may face while waiting for the cycle to turn. A saying we have in the office is that “it’s hard to get hurt falling out of a basement window.” With the help of our network of contacts around the globe, we can wait more patiently and with more confidence for the market to realize the value that we see. •