Chief Conclusion

Our level of caution varies depending on where we are in the cycle in terms of time and valuation. The discipline of replacement cost analysis helps us in this endeavor.

Cartoons on Saturday morning were a fun part of my childhood – cartoons and the chocolate ice cream that my Mom let me eat for breakfast while I watched them.

I can still picture the scene in the “Road Runner” when a determined Wile E. Coyote (shown below) chases the Road Runner right off the cliff. Wile E. hangs there for a moment, legs spinning madly, before he realizes that he is in the air and then tumbles toward the canyon floor below, making that whistling sound that only bombs and falling cartoon coyotes make.

Sometimes investors pursue with no less self-destructive passion their own Road Runner in the markets.

Sometimes investors pursue with no less self-destructive passion their own Road Runner in the markets.

We admire Wile E. Coyote’s persistence in trying to catch the Road Runner just as we admire the enthusiasm certain investment managers display to always beat the market averages. But what of the risks that they are running to do so? And what happens if they get it wrong? In their zealousness to always exceed or at least look like the market, are investment managers placing their clients at risk of a whistling crash on the desert floor below? We think that the answer is yes and believe that risk is unacceptable.

If the Market Were Down 40% and Your Portfolio Was Down 39%, Would You Consider that Outcome “Successful?”

I have asked the question above many times. Never has anyone answered in the affirmative.

Our desire to outperform is no less keen than that of others, but our enthusiasm is tempered by a constant focus on the risks that we must run to do so. We have a view to never running out over the cliff’s edge and being Wile E. This means that we must have a view on where we are in the cycle as a key input into how much risk we are willing to take to achieve our returns. Our goal is to put ourselves in a position where we can outperform materially in challenging markets. The potential cost of doing so is underperforming into the final innings of the market’s peak.

Life is about choices. This is the choice we have made, to err on the side of safeguarding client wealth rather than chasing the last few percentage points of upside. It’s the promise we have made to ourselves about how we want to be known and held accountable. Our goal is thoughtful participation in rising markets while never compromising our discipline of strong downside protection and of mitigating catastrophic losses.

A Key Question: Where Are We in the Cycle?

Of all the things about which reasonable people may disagree, nothing is more reasonable than that the future is unknown. As investors, we must make educated guesses about the future. We try to stack the odds in our favor by using every trick we have learned in almost twenty years of professional investing. After all this time, we are fervent believers in prioritizing investments that we believe have limited downside yet multiple ways to win.

Done correctly and repeatedly - over the long run - this methodology should identify more winners than losers, and hence lead to a successful multi-year investment campaign. At bottom, successful results come from winning more when we are right than losing when we are wrong.

A key part of that discipline is that our risk-taking changes over the course of the cycle. Our goal is to take on more risk earlier in the cycle, when valuations are low and rewards are high, rather than later in the cycle, when valuations are high and therefore the potential rewards are lower. This is only common sense, is it not?

Accordingly, our cyclical framework has two separate but often related components: time and valuation. How deep are we into the current cycle? This is the cycle’s time component. Deeper into the cycle, it is a reasonable assumption that downside will begin to exceed the upside so we become more cautious.

The second component, valuation, can be defined in many ways. Our favorite metric will always be replacement cost – the value of a company in the market relative to the cost to build their assets anew – the cost to “replace the assets.”

Replacement Cost Provides a Guide for Management

The market sometimes chooses to value a company’s assets at less than the cost to replace those assets. When it does so, the market is essentially saying that the company should halt capital expenditures, since any spending destroys value. Let me explain:

If the market values a company at half the cost to replace its assets, every new dollar that the company spends to expand capacity instantly gets marked down by the market to fifty cents. That equals 50% value destruction! Even if the market were to recover and value those assets at higher than replacement cost at some later time, why would a company build new assets when they could buy existing ones at half the price? So, how should a company’s management team, which is charged by its shareholders with optimizing the return on the company’s assets, respond? As always, by seeking to grow capacity per share most cost effectively.

In this case that would be to either 1) repurchase shares of the company in the marketplace since those assets are on sale cheaply or 2) purchase competitors in the marketplace whose assets likewise trade at the same depressed valuation. This second choice can add value by combining the assets of two companies. This often lowers the per unit cost of production due to better capacity management and other cost savings from economies of scale. Fewer competitors also seem to make for improving economics.

Over time, combining competitors in an industry can stabilize returns even in the most troubled industries – which usually leads to higher asset values. Since low valuations are usually the result of supply in excess of demand, a more consolidated industry often curtails excess supply at the same time demand begins to come back, balancing supply with demand more quickly.

The Limitations of Replacement Cost as a Guide

The Limitations of Replacement Cost as a Guide

Investors have to be mindful of the limitation of replacement cost as a guide. Consolidation at prices below replacement cost will not be a panacea for an industry in the midst of structural decline. These are the proverbial buggy-whip industries – those were demand is declining and will never come back, such as the “horse drawn carriage” shown above and its buggy-whip. Buggy whips were displaced by the automobile – the “horseless carriage,” which needed no horse and hence no whip thus making buggy whip factories worth far less than their replacement cost. The industry just disappeared, unmourned, and its factories were sold to other uses. An industry must earn its right to exist. This means that the market will not support valuations for companies with no sustainable long term output.

In recent times, the newsprint industry has been an example of a buggy whip industry. Newsprint is the form of paper upon which newspapers are printed. The internet killed the print newspaper business. Demand for newsprint declined by over 10% per year during many years in the late 90’s and early 2000’s. It is likely that newsprint demand will never come back.

Many value investors lost money investing in newsprint companies because they did not understand that newsprint was a buggy whip industry. Without an economic future, one where the output of those assets is needed, assets that trade below replacement cost are not an opportunity but a warning. Investors must correctly decide which one.

Trading below replacement cost helps solve the problem of overcapacity by bringing supply and demand back into balance. This is why buying companies that are undervalued on a replacement cost basis can be a rewarding investment – as long as they are not buggy whip industries! You see a lot more assets trading under replacement cost at the start of a cycle, when the overhang of excess supply from the prior cycle weighs the heaviest – but be vigilant that the cycle is not a secular buggy whip.

Over-Valuation Is Also Self-Correcting – and is a Hallmark of an Aging Cycle

When a company is valued at greater than the cost to replace its assets, it creates a potentially unhealthy and equally self-correcting dynamic. In such cases, the market is willing to capitalize each dollar spent on new assets into more than one dollar of stock market value. As an example we will use our cartoon friend Wile E. Coyote’s favorite supplier of Road Runner catching devices, the Acme Explosive Company, where demand is literally booming.

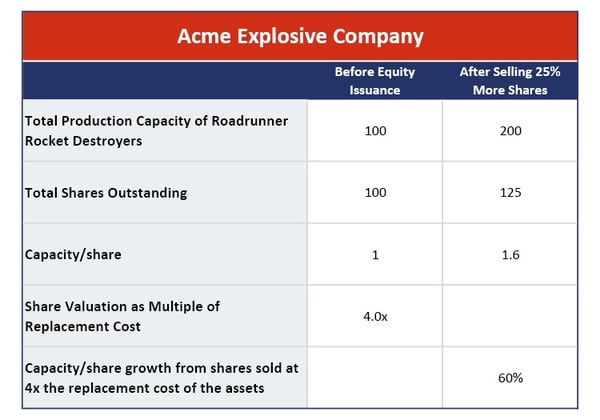

Accordingly, the stock market in its excitement values Acme at four times the cost to replace Acme’s assets. Acme could issue shares equivalent to 25% of its total shares outstanding and double its capacity! The net gain, on a capacity/share basis would be 60% as the table below illustrates.

In this example, Acme’s management has the incentive to issue shares to finance a capacity expansion. If the market chooses to value a sufficiently large number of companies like Acme at a premium to replacement cost, then we can reasonably anticipate that the market may facilitate a premature end to the boom through financing a flood of new supply that will overwhelm demand. For this reason, the deeper into an economic cycle, the riskier investing becomes. Premium valuations can quickly give way to oversupply. Replacement cost valuation is hard at work behind the scenes balancing supply with the demand.

In Conclusion

When conditions of over-valuation proliferate, we can reasonably anticipate that the market’s higher valuation may be setting into motion the very conditions that would call an end to the upcycle. Overvaluation is therefore an aggressively negative fundamental development. Naturally, the best strategy at such points in time is to invest more carefully.

Long-standing clients will not be surprised by our ongoing note of caution given that we are deep into an upcycle with a growing pool of assets trading at more than the cost to replace them. These two reasons: time and valuation, are the regulators of how aggressively we invest, so our investments at this time are more conservative.

Our promise to our clients is to be ever mindful of these cycles and to be prepared to invest accordingly. Our goal is help our clients to avoid the fate of Wile E. Coyote. No doubt, his whistling fall and distant “thud” on the dusty canyon floor make for amusing Saturday morning entertainment, but our clients’ wealth deserves a better fate. We attempt to achieve this by using the tools of the trade learned through our nearly twenty years of professional investing, adjusting the risks we take relative to where we are in the cycle.

The success of this long upcycle is creating the over-confidence that fosters less attractive valuations. One day, however, the prevailing tone in the market will be one of deep pessimism that is more than fully reflected in widespread valuations of companies trading under replacement cost. We are always on the lookout for such situations and will be the first to welcome when they return in mass to the market. Until that time, we have adjusted our risk-taking appropriately, taking targeted shots at what we believe are the best opportunities.•