Cycles and their changing phases are everywhere around us. The twenty-four hour daily cycle comprises the opposites of day and night. The seasons transition from the cool of winter to the opposite heat of summer, before swinging around again back toward cooling. There are also cycles of economic activity with their own changing phases. Economic cycles are no more mysterious than the natural cycles of days and seasons. We can study these cycles to see what they have to say about the ‘economic season’ in which we find ourselves, and thus what we should expect in the economy and in the markets.

The Kitchin Cycle

The Kitchin cycle is named for Joseph Kitchin, the English businessman and statistician who discovered it in the 1920s. Unanticipated changes in business inventories drive this 40 month cycle. Demand is overstated during the upswing into the peak because production is not consumed but rather gets stockpiled in rising inventories. Underlying demand is thus not as strong as it seems. At the peak, demand seems to vanish literally overnight much to the consternation of company executives and investors as consumers meet demand by drawing down inventories (destocking). The destocking cycle runs its course and turns into a restocking cycle once inventories get too low. Additional demand then once more goes into rebuilding inventories, which power a strong rebound off of depressed lows. This volatility in apparent demand can be maddening to most observers but is simply a function of the Kitchin Cycle’s inventory fluctuations. Armed with this knowledge, we can learn to spot the signs that others missed.

Cyclical Analysis and Investing in the Steel Sector

The prices of scrap steel and pig iron are key to understanding the world’s 1.6 billion ton per year physical steel market. This is because the scrap steel price is closely linked to the price of pig iron (an intermediate form of steel made from iron ore and coking coal), through the arbitrage relationship between scrap and pig iron, which are rough substitutes for each other. Understand these principles of arbitrage and substitutes and one will understand commodity pricing in any market, anywhere, as we explain below. These principles are also key to understanding the forces that drive the volatile Kitchin cycle.

When scrap prices fall enough to make pig iron production lose money, the market is using price to send a message to pig iron producers: cut production! Falling prices are the market’s message that the market is in oversupply, and to return to balance, production must fall. Falling prices drive production beneath the level of consumption, which causes inventories to fall as demand is met by running down existing inventories rather than from new production.

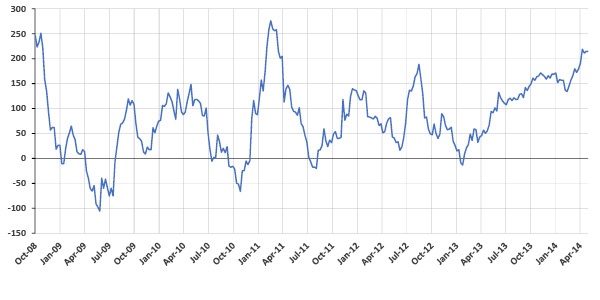

We now find ourselves 39 months past the last major peak in scrap steel prices, which took place at the last peak of the Kitchin Cycle in February of 2011. We are due for a change in ‘seasons’ and should be on the lookout for the hallmarks of a peak, to be rapidly followed by a destocking cycle. We find evidence for such a turn coming out of China. China’s steel exports may start to flow to the US and be the catalyst that pushes the US market into oversupply. Below is a chart of the premium of US steel prices (hot rolled coil sheet steel) to those in China in US dollars per metric ton.

Premium of US Steel Prices Over Chinese Prices ($/Metric Ton)

Source: Bloomberg

China is the world’s largest steel producer and has sheet steel prices more than $200/metric ton below those in the US. The cost to move Chinese steel to the US is perhaps $80/ton. So an enterprising Chinese steel producer can pocket an extra $120/ton profit through arbitrage simply for selling his wares into the US market. Isn’t it logical that lower priced steel should flow from China to the higher priced US market? If imports to the US rise, shouldn’t that eliminate the arbitrage profit between the two markets and perhaps in the process push the much smaller US market into temporary oversupply? Markets strive for balance between supply and demand. Prices in the US, if they fall enough, can remove the incentive for Chinese steel to flow to the US and hold production under the level of consumption for long enough to eliminate excess inventories.

Will the 40 month pattern of the Kitchin cycle repeat again in steel? History suggests that it will. If so, the catalyst is likely to be lower priced Chinese steel flowing to the US markets. Steel prices, and especially scrap steel prices, will render their verdict in the coming weeks. We can use the logic of arbitrage among substitutes to anticipate these future moves. The study of cycles can help in this effort by keeping us alert for signs of change. We will be closely monitoring scrap prices, and other messages of the market, to thoughtfully shepherd your investments through the changing economic seasons.•